End-of-Life Planning for You and Them

Table of Contents

What is an End-of-Life Plan?

This will sound dry and legal but stay with us.

End-of-life (EOL) planning suffers from poor naming in my opinion. What the EOL plan really is are three different buckets of documents and planning directions for you. In combination these documents and directions are powerful and, extremely helpful and kind to those who love and care for you.

This planning is the act of creating, compiling, organizing, and formalizing plans for what happens to you, your identity, your pets, and your things, BUT not just for the end of your life. Some of these plans are activated while you are living.

You plan has three main buckets that all communicate about you, your identity, beliefs, and values.

- Your estate plan

- Your advance care plan

- Additional instructions

"You can make informed choices about everything: your caregivers, your relationships, your medications, your things, your money, and even your breakfast—ice cream sundae, please! - Beth Cavenaugh, RN, BSN, CHPN, certified hospice, and palliative care nurse

What's Ahead? Guidance.

Documents are part of this, but we want you to start with the idea that an EOL plan reflects you and what you value or believe. Embarking on a project of this magnitude is easier with a good mindset and guidance.

More than 68% of Americans say discussing end-of-life plans with family/loved ones is important, but fewer than 47% have yet to do it, according to new survey data from Ethos.

Trust & Will did a recent study about estate planning that discovered that an unprecedented number of millennials (comprising 22% of the population) created a Will or Trust in 2020. This is the first time in history that younger generations are more active in estate planning than their elders. As a result, COVID changed our perceptions about preparedness and priorities.

End-Of-Life Plan Help

The most effort and time-intensive part of end-of-life planning is gathering, filling out, and organizing documents. You may want time to talk with professionals with expertise.

Check out these folks if you have an active caregiving situation and need help.

- Consultants like Eldercare Solutions are experts who partner with you to solve financial issues, review your entire plan and make personalized recommendations.

- Visit an online planning tool like Trust & Will that can get your documents going ASAP.

- Online help that is locally focused is Legal Templates. State rules are different.

- Keep it all organized with Everplans.

- There are fee-only planners at the National Assoc. of Personal Financial Advisors.

add_merchants

Why End-Of-Life Plans Matter

A lot goes into building a life.

Most importantly, if you don't have an end-of-life plan, your state's laws decide who gets everything you own. So that idea alone should get everyone's attention.

Empathy.com’s recent Report found that it takes the average family 13 months to settle a loved one’s affairs; that grows to 20 months if the estate goes into a probate process. Death and taxes are not a joke.

Managing dying and death is a big job, with 57% of respondents reporting “clinical physical and psychological symptoms of stress” due to executing someone’s last wishes.

How to Start Your End-Of-Life Plan

As with any planning, think about what you want as a result. Our approach is empathetic and proactive for those in our life. No one should make difficult and emotional decisions around a hospital bed.

Break the job into manageable tasks, like these five major areas:

- Name your people (designate Trustees, Guardians, or Beneficiaries)

- Gather and prepare legal documents

- Identify assets, debts, and possessions

- Define service, funeral, and burial preferences

- Write an obituary or death notice; we like the ones in the Economist

Steps to Get Your Affairs in Order

Start early, and update regularly.

End-of-life plans reflect your values, identity, and goals for healthy aging. In addition, the plans include legal documents and decisions that need to be in place if you’re hurt or cannot speak for yourself.

Step 1: Talk About It

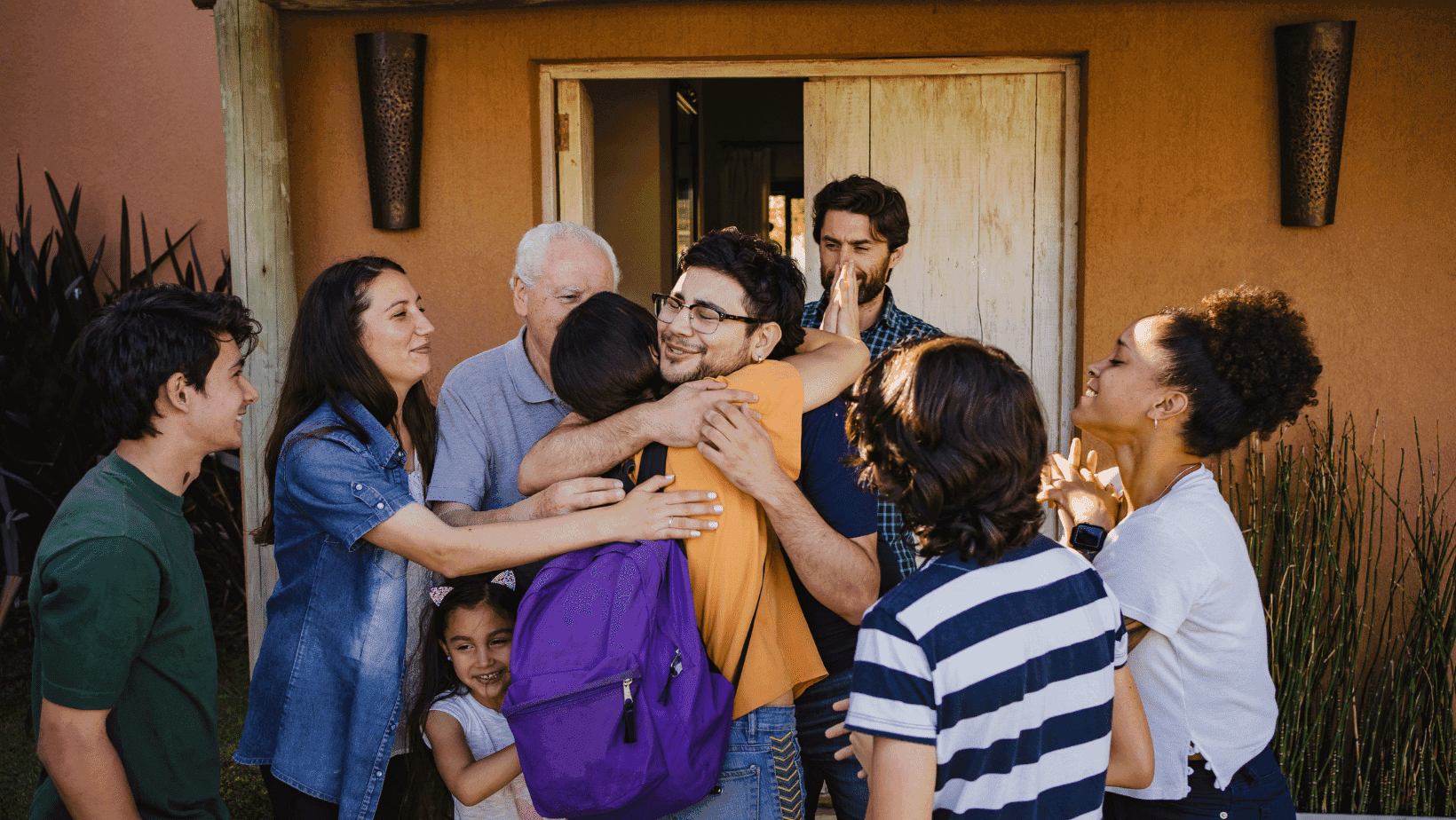

Have honest conversations with the people you chose to carry out your plans on your behalf. Then, identify the team that will manage your finances, assets, body, and soul if you cannot communicate.

End-of-life plan conversations may take people by surprise. Be gentle. Rely on facts and reiterate that this is a standard process.

Step 2: Ask For Their Help

Ensure the people you choose to understand what you want them to take responsibility for and be ready to answer any questions. Also, be prepared if they want to avoid discussing it now or do not want to be part of your plan. You may need a different person for the job. It's ok.

“Always have a backup plan.” - Mila Kunis

Step 3: Revisit Annually

Some parts of the plan require more than one conversation and must be revisited with major life events. Review your plan in case of a significant life change or confirm that you’re still comfortable with your decisions.

The documents you need range from those that follow a death, such as a last will, to those that detail where you want to spend your later years. Everplans has a checklist covering each planning document; we highlight some of the most important ones below.

So that you know, these tips aren't meant to be legal or medical advice but are a get-started guide. This article is a guide to typical planning phases and the documents needed.

Chose Who’s in Charge

The Executor or Personal Representative? With plans, you make that choice.

If you did not set up plans, your state laws list people who will fill the executor role when there is no will. Most states make the surviving spouse or registered domestic partner, if any, the first choice. Adult children are usually next on the list, followed by other family members.

Your Estate Plan Includes the following:

Last Will

A last will serves many purposes, like naming a guardian for children and pets. Decide who gets your assets and property — and who does not and write it out. Wills don’t take effect until after death.

This document is also where you allocate personal property to family or friends of your choosing. In this case, “property” encompasses many assets, such as real estate, vehicles, personal possessions, coin collections, sentimental items, investments, and bank accounts.

This document is managed by appointing a person who will be called an executor (m) or executrix (f) of your estate. This person is responsible for carrying out or executing the terms you define in your will.

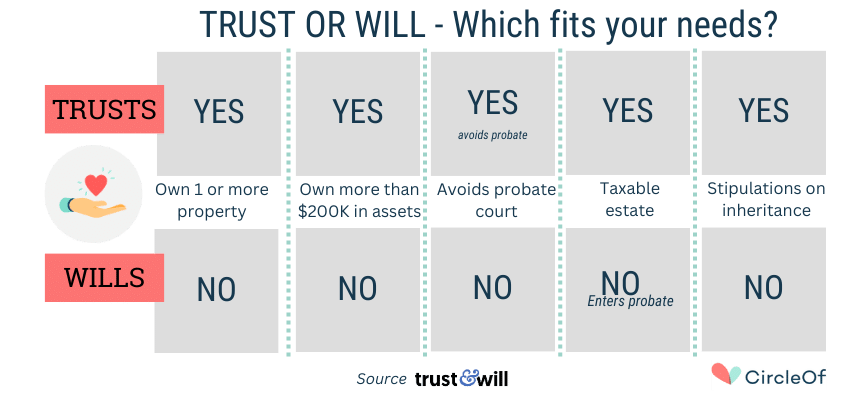

Revocable Living Trust

A Trust is similar to a Will in that it has directions for asset allocation. But there are some fundamental distinctions: a trust can keep your assets out of probate and taxes.

Technically, a Trust is a legal entity, so it can own property and pay taxes. A living trust is any form of trust that is established while you are alive. These trusts can be revocable (you can change it) or irrevocable (tough to change).

People who make a revocable living trust transfer assets to the name of the trust to keep it out of probate. For example, many people put their property in a Trust.

Irrevocable trusts cannot be modified, amended, or terminated without permission from the grantor's beneficiaries or by a court order. Irrevocable trusts are set up for three primary reasons: minimizing estate taxes, getting government benefits (SSDI or Medicare), and protecting your assets from creditors.

Beneficiary Designations, Non-probate

Certain assets aren’t subject to the probate process or included in a will. Yes! Tell us more.

Instead, these assets can be given directly to your chosen beneficiaries. Non-probate assets require completing paperwork with separate companies and naming the heirs. So, for example, if you open an IRA or 401K account, you can call who gets what right there. No hassle.

Durable Financial Power of Attorney

This person is responsible for managing your financial assets and finalizing decisions. Their responsibilities extend to making decisions in the event of your death and in situations where you cannot make sound decisions, such as if you’re medically incapacitated.

The “durable” designation gives this person the legal authority to make decisions. Check out the quick cheatsheet from Trust&Will.

Pet Trust:

Did you know that pets are considered property under the law? So name the new pet parent so the state doesn't do it for you. Pet owners can also establish and fund pet trusts to provide future care, like providing care instructions and your preferred vet. This is how we got our pup.

Your Advanced Care Plan Includes:

Living Will

A "living will" formalizes your wishes for medical care while alive. For example, suppose your health declines, so you can’t make sound decisions. In that case, a living will is the guidance for doctors and medical power of attorney that clearly states what medical treatments, interventions, or procedures you do or don’t want.

Share this with your medical power of attorney so they know your preferences. They need to be confident to make choices that match their requests.

A Durable Medical Power of Attorney

This person makes medical decisions for you. You must get the right person here and name a backup too. It may not be a family member; they may be too emotional to act on your directions. Remember, it's your choice because you are in charge and planning right now.

Specify the medical and health decisions this person can make, ranging from medical treatments to surgery to end-of-life care. Because these are critical decisions, reviewing the details in person is essential. A medical power of attorney is also called a medical proxy.

End-Of-Life Living Arrangements

Where you will live if you cannot care for yourself is a thought-provoking and potentially tricky conversation. What if you need more medical and physical assistance as you age?

Options for end-of-life housing include your house with supporting in-home care, assisted living facilities, or residential full-time nursing homes. Specify your wishes and preferences and how you plan to finance your preferred choice.

DNR and POLST Forms:

Do Not Resuscitate (DNR) and Physician’s Orders for Life-Sustaining Treatment (POLST) forms are imperative if you’re in declining health or are concerned about a current medical diagnosis.

These documents indicate the actions your healthcare power of attorney (POA) and medical providers can take in specific medical events.

In the case of DNR, you can indicate that you don’t want to be resuscitated in an emergency. The POLST includes details for end-of-life care.

Life Insurance

Why don't people get life insurance? Concerns range from picking the wrong coverage amount, affording premiums, not thinking they need it, and concerns coverage qualifications.

A 2022 Insurance Barometer Study finds 35% of millennials say they don't own life insurance because it is too expensive, yet 8 in 10 millennials overestimate the cost of life insurance. In addition, it is typically cheaper the younger and healthier you are.

Tip: Many insurers offer free quotes online, making comparing life insurance quotes easy. The best way to start is online and compare quotes from insurers with a company like Bestow.

Situational Documents

"You gain strength, courage, and confidence by every experience in which you stop to look fear in the face." - Eleanore Roosevelt.

Domestic Partnership Agreement

An agreement that protects the rights of two people who aren’t legally married but live together as long-term partners. Domestic partnerships' legal interpretation and registered status vary by state, but this agreement is essential for legal protection.

Digital Executor

This person has the job of managing your digital identity, accounts, apps, and social life. So, just like specific instructions about your physical belongings, be clear about what you'd like to happen with your virtual information.

Who do you trust, and who is technologically savvy? Your 'digital executor' will manage your accounts and ensure everything is properly managed or deactivated. Here’s a list of accounts and categories to consider:

- Password management sites: onepassword or LastPass

- Social media: Facebook, Twitter, Instagram, Facebook, Pinterest, Snapchat

- Finances: PayPal, Venmo, online banking; credit cards; cryptocurrency

- Utilities: gas, water, electric, television, phone, cable, and internet providers

- Health: Patient portals; health insurance; meal delivery; gym memberships

- Entertainment: streaming subscriptions; magazine subscriptions

- Administrative: email; cloud-based services (like Google Drive)

- Shopping: eBay, Amazon, stores

Organ and Tissue Donor

Are you registered to be an organ and tissue donor? That status is on your state-issued ID. Include this information in other health- or medical-related documents to ensure your donation helps as many people as possible.

Inventory Assets, Debts, and Possessions

Assets are anything you own that has either monetary or sentimental value.

Part of your plan is the direction on how assets should be distributed. Why? This saves your family and friends from possibly contentious conversations and streamlines the process of fulfilling your legacy.

In the case of debts, loved ones need to know who is responsible for what’s owed and how the debts will be covered.

Deciding on Funeral and Burial Arrangements

Most people have an opinion on what they'd like done with their body after they die, and there are many traditional and unique preferences and end-of-life practices that you can spell out.

Planning a personal ceremony that respects your beliefs and personality and includes a network of loved ones is an intimate job. You have traditional and non-traditional choices to think about. This is a gathering about you.

End-Of-Life Event Planning

A funeral is a remembrance ceremony held during a person’s death. You get to help decide what works best for you and your circle.

- Celebrations of life honor a person’s memory through sharing personal moments and remembrances from loved ones.

- Graveside services are brief ceremonies held at the burial place. Also known as a committal, this service typically follows the funeral.

- Memorial services are ceremonies after the body has been buried or cremated.

- Traditional funerals in specific religions follow that religion’s ceremonial proceedings.

- Wakes are less formal and often held at someone’s home before a funeral service.

Different Types of Burials

People want guidance on your burial preference. There are lots of options that are available that are very different from even 50 years ago.

Non-traditional Burials:

- Composted to give back to the earth, also called a "natural burial."

- Made into a diamond & become a family heirloom

- Frozen/preserved so you may wake up again

- Burial at sea or a 'Viking funeral.'

- Deep in the ocean or shot into space

- Pressed into a vinyl record for my family to play

- Made into fireworks & displayed

Traditional Burials:

- Above-Ground Burial: Enclosed lawn crypt instead of being placed in the ground

- Cremation: The Cremation Association of North America defines cremation as “the mechanical, thermal, or another dissolution process that reduces human remains to bone fragments.”

- In-Ground Burial: A casket is lowered into the ground, covered, and marked with a headstone; this is the most common burial.

- Mausoleum: This structure is built solely for the burial of human remains, whether in the form of a body or ashes. There are both public and private mausoleums.

Write Your Obituary

Obituaries and death notices are public notifications of a person’s death, with unique differences.

A death notice is a brief write-up that includes the person’s name, birthday and date of death, and details about their memorial or funeral service. People usually pay to have death notices published in local newspapers; statements may also be submitted to organizations closely associated with the deceased.

Obituaries include the same information as death notices but are written like a biography of the person’s life. Obituaries have details about the person's upbringing, family, career, and meaningful personal information. We are partial to the ones created by the Economist.

Help With End of Life Planning

It might seem like it’ll take a small army to cover everything at an end-of-life plan to get everything sorted out. However, if you made it this far in the article, these resources bear repeating.

- Consultants like Eldercare Solutions are experts who partner with you to solve financial issues, review your entire plan and make personalized recommendations.

- Visit an online planning tool like Trust & Will that can get your documents going ASAP.

- Online help that is locally focused is Legal Templates. State rules are different.

- Keep it all organized with Everplans.

- There are fee-only planners at the National Assoc. of Personal Financial Advisors.

Quick Review Documents in a Typical Eol Plan

If you want some help learning which documents suit you, our partners at Trust&Will have an online survey to point you to the essential documents to get in place based on your life now.

You've got this. Planning is power.

|  |

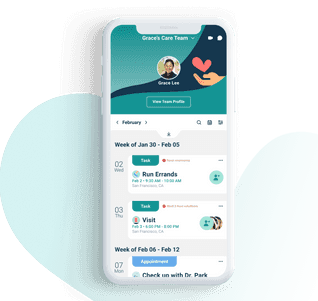

Build Your Family Care Team Today!

It’s no secret that taking care of elderly family members can be a challenging task. Not only do you have to worry about their physical and emotional well-being, but you also have to manage your busy life simultaneously.

If you’re a family caregiver, CircleOf is the app for you. It allows you to organize and collaborate with family and friends, maintain regular communication so everyone is on the same page. Download CircleOf today to build your circle of care.