Financial Planning and Caregiving

Table of Contents

For caregivers of aging parents, older adults, ailing spouses or relatives, finances are front and center of every consideration, option and decision. Creating an agreed to plan and holding to that plan is one of the best ways to protect them and you.

There are real emotional, practical, and relational issues that we grapple with when we address personal finances and expectations. For caregivers, it can seem like current expenses make it impossible for YOU to set aside funds now. Both of you - the caregiver and the person you are taking care of, need to understand finances. Two key questions are to think about are:

"How will I care for my parents and help them age how they want to?Is it possible to take care of myself and my future while caregiving? "

Stats to think about. The Family Caregiver Alliance says that the average duration of a caregiver’s role is four years. According to the National Alliance for Caregiving, 81% of caregivers from 18 to 49 care for someone age 50 or older. In fact, the average millennial caregiver is around 30 years old and caring for a parent or grandparent who is typically approaching 60.

Caregiving for an adult can arrive sooner than you plan if there is an accident or sudden change in health with a spouse or relative. And of course, these life-changing, emotionally charged events may happen at the same time you’re growing your career and/or your young family. We call it the cyclone.

For those of us with aging parents, making a plan for your parents’ care support is literally life altering. Like all plans, the best time to start is now. What to do and where to start?

In this article, we address topics and support to help YOU plan for your parents’ care so you can move forward with more confidence.

First, start the conversation

Planning starts with a conversation. Sit down with your parents and have the “crystal ball” conversation. What do they see, want, or wish for their future self? Ask them to be honest. Listen. Don’t judge. Be open to what they say. Take notes.

One way to grease the skids, as my dad would say, is to talk about your own long-term plans and wishes. Writer Lisa Gerstner introduced her will and financial power of attorney to her widowed mother, which opened the conversational window for her mom to talk about her own plans and hopes for her single life. What works in this conversation is her approach and the a big life change which helps people be open to new ideas.

The point of these talks is to understand their desired housing and health care goals and get a realistic picture of their financial reality. During this process you will get to know your family better and how you may want to plan as well. Some people have some fun with these conversations because they learn things about their family they never knew.

How much care do or will my parents need?

Try to get insights on how much care your parents need now and how that may change in the future. Work through the following four categories and questions to get an idea.

Place: Where they live.

- Is your parents’ living space safe for them as they age?

- Do stairs, doorways, or bathrooms pose a problem?

- Can spaces be remedied with home modifications?

People: Who’s available and willing?

- Who else can share caregiving responsibilities?

- Make a list of potential and current caregivers and get your parents’ agreement

- Important: keep this list current

Health: What are your parents’ current medical needs?

- What conditions are your parents currently dealing with and what kind of care do they need, now?

- How often do your parents go to doctor’s appointments or have medical treatments?

- What are their prescriptions?

- Do they need or want in-home services?

Finance: Money and affordability are major influences over most decisions.

- Are your parents financially able to meet their current expenses?

- Are your parents cognitively able to manage tasks such as driving to the bank or paying bills?

- Are they physically and mentally capable?

In essence, you need to understand how much they can financially, mentally and physically handle on their own. If you need more ideas about where to start, Aging Care has a printable activities of daily living assessment that is a helpful tool to help envision and evaluate the extent of your parents’ needs.

Ask yourself -‘What is my capacity?’

Next, evaluate your personal financial, physical and mental capacity so you don’t end up burned out or in debt.

Gut check questions:

- Am I comfortable leaving my job or cutting my hours, income and savings?

- How will I provide for myself and my family if I work less?

- How much do you have available to give in terms of financial support?

Be Real Honest.

The gap between your capacity and your parents’ needs is where you need to find ways to ‘fill the gap’ together.

Money Matters

Finances are not typically an easy fun conversation to have. But from my recent experience, what you can afford is one of the biggest determinants of the care you will get.

AARP estimates that an average caregiver spends between $7,000 and $13,000 every year supporting an aging or ailing relative. Your conversation needs to include the benefits and resources your parents currently have (or will have) when they need it.

A standard financial recipe of care support is benefits + personal insurance with in-home care + retirement savings + Medicaid programs.

Note: Even if your parents have financial resources available, you may still end up pulling from your own savings to help keep your parents comfortable and cared for.

Getting outside help with planning

A smart step is to talk with a financial advisor who has experience advising family caregivers. They will help you lay out a realistic budget. Eldercare consultants are real helpful and, most times, find and save people money.

Government programs, like Medicaid, may help cover some long-term care costs. Benefits.gov is a government search platform to help you figure out what benefits you and your parents are eligible for and how to apply.

Employer benefits can also be savings for your parents’ care as well as your own retirement. Recent research shows that more than two-fifths of 401k holders have taken loans from their retirement accounts in the previous five years.

An increasingly common alternate employer managed option is a sidecar account. This is a savings account that sits alongside your retirement account and can be used for emergencies and short-term care necessities. You will not get tax penalties for taking out funds. These accounts are funded through automatic payroll deductions. If your employer does not offer the sidecar option, you can set up your own version by automatically depositing part of your paycheck into a high-yield savings account.

Health savings accounts (HSAs) provide tax-free savings for most medical expenses. Cover eligible out-of-pocket healthcare expenses by combining an HSA with a high-deductible plan. The bonus here is that the funds in these plans accumulate interest until they’re used and roll over from year to year. Some employers also offer matching contributions.

Get paid for family caregiving if you reduce your hours or leave the workforce, saving is still possible. You can ask your family to pay you as an independent contractor and set up a simplified employee pension (SEP) plan.

As you work on a family financial plan, consider asking your parents to create a care agreement (AKA a long-term care personal support services agreement, elder care contract, or family care or caregiver contract). This legal contract covers details like where they’ll live, whether you as a caregiver get financial compensation, and your specific responsibilities. Everplans can help you lay out your financial and logistical decisions with a streamlined platform that keeps all your plans and associated documents organized in one place.

Support Options for Caregivers

Caring for an aging family member is a lot of details, time and relationships to manage, but there are resources to help make some of the financial tasks easier. Your area agency on aging can be a resource to find local paid support.

One type of support I had never heard of before I became a caregiver is a care consultant, AKA a care manager. These paid experts stay current on all financial, government, and legal aspects vital to caring for adults. Make sure that you engage with a consult with a specialty either in eldercare or vulnerable person needs.

Care consultants start with an assessment of you and your family’s’ needs and then help in two major ways. First they have the expertise, know the language and terminology to help you understand all your options. This helps with the ‘tough’ conversations that are part of managing everyone’s expectations.

Next they make a strategy and a care plan, locate care providers, and provide continuing support. A care consultant is like a smart, willing older sibling, but without the family complications.

Before we close out, let’s talk about setting up legal documents for a quick minute. “Yay! Legal documents” says no one. My family used Legalzoom to help learn what we needed, create documents to preserve our parents’ choices, including wills, healthcare directives, and financial power of attorney. For more legal help, get info based on your location through the Legal Services Corporation directory. You can also contact your state or county law library for information about forms, court processes, and get referrals to legal aid providers.

Care happens; get the support you all need.

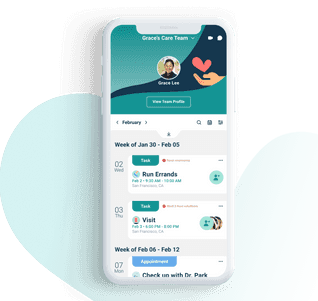

CircleOf is a free mobile app designed to help you build a circle of care for you and the person you are taking care of.

What’s an app got to do with help? Like financial planning, support is in the details and adult caregiving is a lot details, support coordination, and time.

Caregiving in CircleOf is secure and private. Don’t only use a notebook and your unsecured messaging app for private details, organizing, planning and schedules. Keep the it tidy, in one spot accessible to you and your team in CircleOf.

You can do this — and you deserve help along the way.

Just in case you are not ready start planning for retirement now, read this! It was recently National Retirement Security Week!

- The average retirement age in the U.S. is between 62 and 67 years.

- 80% of Americans say that saving for retirement is critically important.

- 56% of Americans actually are saving.

- This observance is about raising awareness and helping individuals take concrete steps towards creating secure retirement.

1 About NOLO care

Build Your Family Care Team Today!

It’s no secret that taking care of elderly family members can be a challenging task. Not only do you have to worry about their physical and emotional well-being, but you also have to manage your busy life simultaneously.

If you’re a family caregiver, CircleOf is the app for you. It allows you to organize and collaborate with family and friends, maintain regular communication so everyone is on the same page. Download CircleOf today to build your circle of care.