After I Die, What Happens to My 401(k)?

Table of Contents

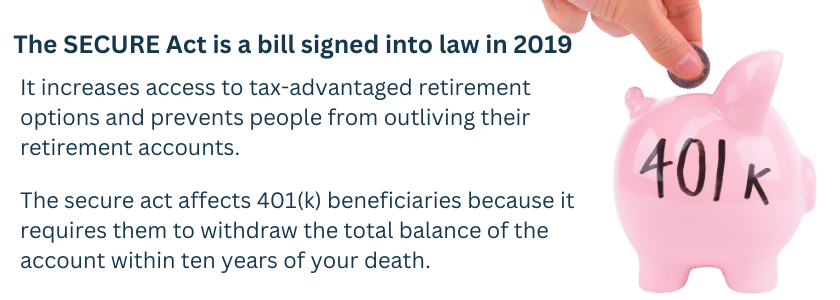

A 401(k) is an employer-sponsored retirement plan that allows employees to contribute pre-tax funds throughout their working career.

If you have invested money into a 401(k) with an employer throughout your professional career, go you! That’s a great retirement strategy. But what happens with a 401(k) once the owner dies?

In this post, we address that and other questions that come up as part of protecting a family’s happiness and financial well-being in the event something happens to you.

Who Inherits My 401(K) When I Die?

Typically when you die, the 401(k) funds should automatically transfer to whoever was named as the beneficiary. Many people name their spouse, though you can name someone else, such as a charity or no one at all. On the outside, it seems simple enough because you get to choose.

What Is a Beneficiary?

At its simplest, it is someone who benefits from something — but we want to keep this in the 401(k) context. A beneficiary is a person designated to receive financial compensation from an estate or insurance policy.

When someone first sets up their 401(k), they can name a beneficiary. However, some people don’t do this because they do not know who to designate or which assets to allocate.

If a person doesn’t define a beneficiary, the power of this decision will transfer to the state laws where you live.

Don’t Leave the Beneficiary Box Blank

Relationships and values change over time. We recommend naming a person or institution as your beneficiary when you open the 401(k) and then revisiting your beneficiaries at least every five years.

If you need advice from professionals to discuss these and other scenarios, please check out our reliable partners below.

add_merchants

Can a Child Be a Beneficiary?

“Can my child inherit my 401(k)?” The answer is — yes, potentially. But it’s not as simple as naming them a beneficiary.

If you want your children to inherit your 401(k), you need written consent from your spouse verifying the designated beneficiaries and distribution plan. (You need written permission to name someone other than your children as beneficiaries, too.)

Whether you select one beneficiary or multiple determines how you want to allocate the required minimum distributions. Remember, choosing a beneficiary isn’t just about protecting your financial future but also providing financial security for loved ones or causes.

A Surviving Spouse

Are you married or in a registered domestic partnership? People typically list a surviving spouse as a beneficiary on their retirement savings, like a 401K. The U.S. federal law also states that spouses and registered domestic partners automatically inherit their deceased partner's 401(k).

Your surviving spouse will sign a consent waiver if additional beneficiaries are named. Similarly, if a surviving spouse wants to make any changes to the beneficiaries on the account, the 401(k) provider has to receive written consent.

If you were never legally married to your partner, they’re not entitled to inherit your 401(k). Instead, you must follow the appropriate steps to designate them as a beneficiary on your account.

In the case of a divorced surviving spouse, beneficiary rights can be retained unless the account owner explicitly removes them as a beneficiary in the divorce decree. The rules may differ in your state, so you can research it while retirement planning and update it regularly with any significant life change.

Someone Else

Depending on your marital status, you may decide to assign someone else as your beneficiary. This is especially common for single people. For example, you can name your parents, siblings, children, or even a trusted friend. If there are no specific individuals you wish to call, you can choose a charity as your 401(k) beneficiary.

But again, if you’re married, you’ll need written consent from your spouse before designating any of these other people or organizations as your beneficiary.

Can Your Pet Be a Beneficiary?

Pet parents ask this question, too. In the eyes of state and federal law, pets are considered property, meaning you can't leave them an inheritance or make them the direct beneficiary of your 401(k).

One way to ensure that your favorite pet is taken care of after you die — even if you cannot leave your beloved companion any funds directly — is to create a trust known as a ‘pet trust.’ We have other articles on this but know you can still provide for your pets' continuing care.

What if There Are No Assigned Beneficiaries?

Did you know that you also can select no beneficiary? Why would that happen?

Whether this is an intentional choice (in the case of an untimely death, some people die before they name a beneficiary), your funds automatically go into your estate and then go through probate.

Probate is expensive and time-consuming and includes people with legal rights to your estate and benefits in the event of death. On the other hand, not selecting a beneficiary is risky, and the government takes over and makes decisions.

If you are still determining who to assign as a beneficiary when you open the account or when you are revisiting it, consider your favorite charity.

Do Beneficiaries Pay Taxes on 401(K)?

What does it mean to my beneficiaries' tax situation when they inherit a 401(k)? There are considerations that can help minimize your heirs' tax liability and maximize their inheritance.

A beneficiary’s 401(k) inheritance will be taxed as income. The amount an heir will pay is based on their income tax rate at the time. This is what tax bracket they are in when they get the inheritance, not that of the original owner of the 401(k).

Governments have a significant interest in transferring wealth. With the global aging population, we’re on the cusp of the essential generational wealth transfer in history, with baby boomers set to pass to their children or others more than $68 trillion.

Typically, money in a 401(k) is untaxed funds. However, one exception is a Roth 401(k), which is supported with after-tax dollars, so those withdrawals are generally entirely tax-free.

Your beneficiary’s tax impact also depends on how they receive your funds.

Tax Tips for 401(K) Beneficiaries

If you have saved and invested money and named a beneficiary, you’ve taken all the proper steps. So, how can you help prepare people for the gift of money they will receive if you are gone? Good communication is critical to helping people feel comfortable with an inheritance of any size.

The beneficiary or contingent beneficiary deals with tax implications depending on their relationship to you and their age at your death (are they a minor child?), among other key IRS relational and capacity definitions.

Minimum (Required) Distributions (Rmd) (MRD)

If you’ve chosen to support your beneficiary for an extended period financially, your best option is to select the required minimum distributions. This option allows your beneficiary to receive equal amounts over a set timeline (for example, ten years), helping to ensure their financial security for the foreseeable future.

While they’ll still owe income tax on these distributions, your beneficiary won’t incur penalties like 10% of the asset total.

Lump-Sum Distributions

As the name suggests, your beneficiary can cash out the entire 401(k) account in one transaction. Again, the total amount is subject to their income tax level — and possibly estate tax if the estate is large enough.

A lump-sum distribution option benefits your employer by releasing them from the burden of maintaining an account for an employee who no longer works for them. It’s always best to consult with your employer or a tax professional to identify whether your current 401(k) plan opts for an automatic lump-sum distribution.

Rollover Distribution

Your beneficiary can also roll the entire 401(k) account into a new or existing inheritance account rather than cash out the whole balance.

The benefit is that no taxes will be due when the rollover is initiated. Instead, taxes won’t be deducted until funds are distributed. This is a standard option if the 401(k) account administrator only allows funds to be distributed when the account holder dies.

What About My Other Investments?

Your main goal with all your worked and planned retirement assets is to get it to the people or organizations you choose—not the government—unless you want to give it to the state you live in!

Please consult with your financial advisor to figure out any additional steps that need to be taken to ensure your investments are in order.

If you don’t have access to a financial advisor (or want to research beforehand), you can ask the experts at JustAnswer for help with your legal or tax-related questions. Just Answer is a service that gives you access to qualified CPAs and gets tax answers in minutes.

We also trust our friends at Legal Zoom for their estate planning resources and professional legal advice. LegalZoom has a simple online process for creating your living trust that is affordable, completely legit, and trustworthy. Click here to get 15% off.

What to Do Next

You’ve taken the first step and are likely on a roll. Let’s make sure you have the information you need to get your financial self ready for whatever you or your family needs.

For affordable, professional help with estate planning — including wills, trusts, and other vital end-of-life documents — look to Trust & Will (then organize all those documents in one place with Everplans). With years of experience under their belts, you can find the answers to all of your financial and legal questions.

Disclaimer: The content presented in this post has been gathered from online research and vetted with our editorial group. It is intended to serve as general information, not professional advice for any individual. We recommend discussing your plans with a qualified professional for personalized tax or legal estate planning advice.

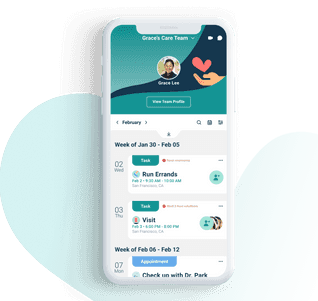

Build A Family Care Team Here

Retirement planning is a beautiful gift for you and your loved ones should you have an untimely death. These are acts of care.

As a family caregiver, you will also manage others' health and finances, and CircleOf is the app for you. Our mobile app is designed to help you establish a circle of care for yourself and those you care about.

You can manage, organize, collaborate with family and friends, and maintain regular communication so everyone is on the same page. Download CircleOf today to build your circle of care.

Bonus Content

IRS 401k Resource Guide

According to the Internal Revenue Service (IRS) 401(k) Resource Guide, distributions can’t be allocated from a 401(k) account unless one of the following occurs:

- The account owner dies.

- The account owner's employment status is severed.

- The account owner becomes disabled.

- The 401(k) plan is terminated and has no designated beneficiary.

- The account owner turns 59½ years of age.

- The account owner experiences some type of financial hardship.